Retained Earnings: Definition, Calculation

Retained earnings refer to the historical profits earned by a company, minus any https://www.bookstime.com/articles/is-it-hard-to-be-a-bookkeeper dividends it paid in the past. To get a better understanding of what retained earnings can tell you, the following options broadly cover all possible uses that a company can make of its surplus money. For instance, the first option leads to the earnings money going out of the books and accounts of the business forever because dividend payments are irreversible. There is a rapidly-growing market for this product in some countries, so the company’s managers have decided to retain all profits within the business, in order to fund that growth.

What Is Retained Earnings to Market Value?

Paying off high-interest debt also may be preferred by both management and shareholders, instead of dividend payments. Management and shareholders may want the company to retain earnings for several different reasons. Being better informed about the market and the company’s business, the management may have a high-growth project in view, which they may perceive as a candidate for generating substantial returns in the future. Retained earnings are also called earnings surplus and represent reserve money, which is available to company management for reinvesting back into the business. When expressed as a percentage of total earnings, it is also called the retention ratio and is equal to (1 – the dividend payout ratio). In the business world, understanding how to properly contrast net income vs retained earnings can be a key differentiator for a company’s success.

Are Retained Earnings a Type of Equity?

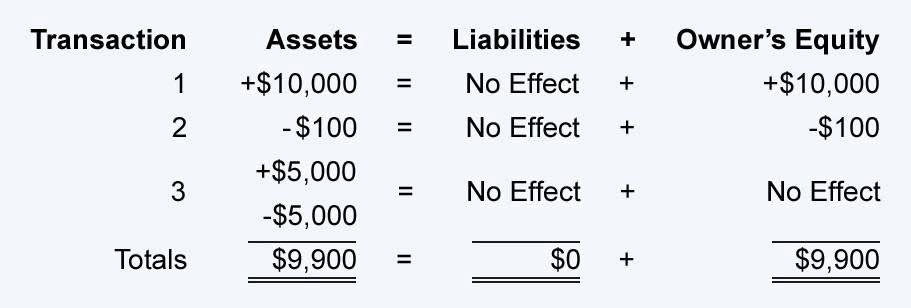

Now that we understand the basics and types of revenue reserve accounting, let us apply the theoretical knowledge to practical application through the examples below. Revenue reserve accounting helps a company become stronger from the inside out to serve its shareholders for years to come. On the surface, it would seem that there’s no relationship between the operating efficiency of a business and the retention ratio. But in actuality, a company would be able to retain more when the “net profits” are noteworthy.

FAR CPA Practice Questions: Calculating Impairment Losses

For example, financial institutions are often subject to strict regulatory capital requirements that affect the use of these earnings. Companies should adhere to these regulations to maintain their financial stability and legal compliance. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

- While surplus reserve and undistributed profit both represent portions of a company’s profits that are not distributed to shareholders as dividends, they have distinct attributes that set them apart.

- Retained Earnings are a vital financial metric that sheds light on a company’s financial strength and growth potential.

- By understanding how retained earnings impact cash flow, investment opportunities, and overall profitability, companies can proactively plan for future growth and expansion.

- It indicates that the company has accumulated losses over time, which can erode shareholder confidence and affect investment decisions.

- This financial strategy allows companies to fund growth, repay debt, invest in research and development, and weather economic downturns.

In its most recent year of operations, Failsafe generated $10 million of profits, all of which it elected to retain. Undistributed profits are those earnings of a corporation that have not been paid out to investors in the form of dividends. A rapidly-growing business needs earnings to fund its future growth, and so will likely retain all of its earnings. Conversely, a slow-growth company has no internal need for the excess cash, and so will be more likely to pay out a large proportion of dividends.

- A company is normally subject to a company tax on the net income of the company in a financial year.

- Unappropriated profit, often referred to as unappropriated retained earnings, represents the portion of a company’s earnings that remains undistributed or unallocated for specific purposes.

- In many jurisdictions, companies are required to maintain a minimum level of surplus reserve as a safeguard against financial instability.

- When total assets are greater than total liabilities, stockholders have a positive equity (positive book value).

- Profits generally refer to the money a company earns after subtracting all costs and expenses from its total revenues.

- These purposes could include reinvestment in business operations, debt repayment, or saving for future opportunities and contingencies.

Understanding Undivided Profit

- Even though the company was doing considerably well, it could have paid off existing debts or declared dividends.

- Consider other factors, such as market trends and competitive positioning, when making investment decisions.

- After the initial public offering (IPO), Apple Inc. kept all its profits as revenue reserve for a few years.

- Read this post and dive into this insightful guide to unravel the mysteries behind net income versus retained earnings.

- These profits are typically retained within the business and are not paid out as dividends to shareholders or designated for any particular use.

This means that the value of the assets of the company must rise above its liabilities before the stockholders hold positive equity value in the company. We need to understand here that the revenue reserve accounting of a company isn’t just on the books of the company. One approach is to improve operational efficiency to generate more profits and offset previous losses. Another strategy involves reducing expenses and optimizing costs to enhance profitability and gradually eliminate negative retained earnings.

Balancing reinvestment and dividend distributions based on retained earnings is a delicate process. The impact of retained earnings on decision-making is profound, as it provides businesses with the resources needed to capitalize on emerging opportunities or navigate challenging economic conditions. For instance, if a company experiences high profitability (reflected in increased net income), it can choose to retain more earnings for future investments or expansion. Increasing Retained Earnings suggest that a company is saving more of its profits for future growth or to strengthen its financial position. Depending on the jurisdiction and industry, there may be limitations on how companies can use retained earnings.

Net Income Explained

Whether you’re an individual investor or a financial professional, keeping an eye on a company’s Retained Earnings is essential for a well-rounded financial analysis. Accumulated income refers to the portion of net income that is accumulated and used for reinvestment purposes or to pay down debt rather than being paid out in the form of dividends. A general reserve is created to meet future contingencies or for general business purposes, and a specific reserve is created for https://www.facebook.com/BooksTimeInc/ a specific purpose, such as dividends or bonuses.

- The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the shareholders.

- A general reserve is created to meet future contingencies or for general business purposes, and a specific reserve is created for a specific purpose, such as dividends or bonuses.

- By examining both metrics, analysts can better understand how effectively a company balances its short-term profitability with long-term growth objectives.

- Retained earnings significantly influence strategic decisions related to reinvestment and dividend payouts within a company.

- In this guide, we’ll break down the concept of undistributed profit in simple terms, explore its significance for companies, and provide examples to illustrate its impact on financial decision-making.

- Companies can reinvest these earnings in non-cash assets or operations, making it important to assess the company’s cash flow separately.

This steady growth in equity reflects positively on the company’s overall value, attracting potential investors who seek long-term returns on their investments. The accumulation of retained earnings signals financial strength and prudent management practices, enhancing shareholder confidence in the company’s performance and future prospects. These retained earnings can be used as undistributed profits that have accumulated in the company over time are called “undistributed profits” to reinvest in the business. In summary, surplus reserve is a strategic financial tool that companies use to set aside a portion of their profits for future use. It provides a financial cushion for the company, helps fund growth initiatives, and demonstrates the company’s commitment to long-term financial stability. Surplus reserve serves as a financial cushion for the company, providing a source of funds that can be used in times of need.

Leave a Reply