Revolutionize Your pocket option trading strategy With These Easy-peasy Tips

Best Stock Trading Apps of 2024: Your Ultimate Guide

Traditional stock brokers often work for corporations and may earn commissions on the products they sell you they are salespeople, and that may affect their advice. Losses could potentially exceed your initial investment. Subscribe to trading signals, discuss trading strategies on our internal chat, and buy strategies and bot templates from our marketplace. “Why Bank With Acorns. Full Risk Disclaimer. Using put options to establish a stock entry at a specified price. Trading activity and academic interest have increased since then. Once an investor installs this software onto a platform, they can let it run on its own. The Nasdaq is an example of a virtual trading floor in which stocks are traded electronically through a network of computers. John Bringans is the Senior Editor of ForexBrokers. Position trading is a popular long term trading strategy that allows individual traders to hold a position for a long period of time, which is usually months or years. Intraday traders take positions and make the best of the price movements within the day. Downside put option, while at the same time writing an OTM upside call option for the same stock. 70% of retail investor accounts lose money when trading CFDs with HF Markets Europe Ltd. Many market participants often don’t get the right guidance and suffer losses. These appear in the debit side of Profit and Loss Account while Commission received, Discount received, profit obtained on sale of assets appear on the credit side. If you find trading interesting already, we are sure that you will find strategy development fun and rewarding. Common tools for scalp trading include technical indicators like SMA, RSI, VWAP, and Bollinger Bands. Definitions and key trading examples.

Advantages and Disadvantages of Algorithmic Trading

Here is the detailed share market holiday list 2024. Yes, meditation can help with trading performance as it fosters heightened concentration, diminishes stress levels, and supports emotional equilibrium—key factors in executing rational trading decisions. HDFC Bank Share Price. Vega indicates https://pocketoption-ru.online/ the amount an option’s price changes given a 1% change in implied volatility. FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries. BlackBull Markets and its associated entities have access to provide over 26000 tradable instruments to clients across all our Trading Platforms. It’s important to note that learning to invest is not a one time endeavor but a continuous process. A standard size options contract is equal to 100 shares of the underlying security. We take complete care of the security and privacy of any person who comes to download any color trading app from our website. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading.

Advantages of Opening a Trading Account

These are leveraged products, meaning you’ll pay an initial deposit called premium upfront to open a position. Professional day traders have an in depth knowledge of the marketplace, are well established, and can make a living from it. How to Invest in Share Market. The incorporation of moving averages into a candlestick chart facilitates the identification of dynamic support and resistance levels. MTFs do not have a standard listing process and cannot change the regulatory status of a security. In Currency Trading For Dummies, you’ll find an everyman’s guide to participating―and profiting―in the currency markets. The MACD is significant in options trading as it helps you identify the strength and direction of a trend. Please see Robinhood Financial’s Fee Schedule to learn more. Later Dan https://pocketoption-ru.online/viewtopic.php?t=219 gained insight into the forex industry during his time as a Series 3 licenced futures and forex broker. This includes buying and selling crypto using fiat and other crypto assets, employing advanced trading features, and earning crypto through several earning tools.

See also

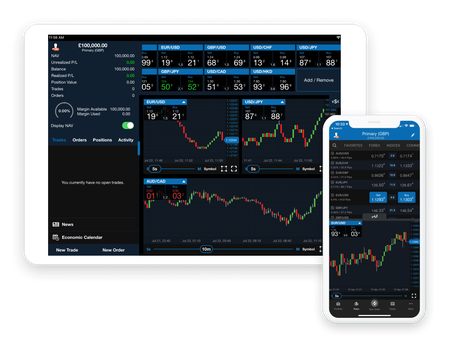

Swing trading seeks to capitalize on the upward and downward “swings” in the price of a security. Apple iOS and Android. There are no shortcuts when it comes to trading success, but the effort they put in was clear from their results. 7 Best Performing ESG ETFs. Tastyfx aims to offer a more aligned experience for their US based providing Americans access to the global forex market with leverage and tight spreads. Bitcoin is traded 24 hours a day, seven days a week on exchanges around the world. On a certain occasion, it was predicted that the season’s olive harvest would be larger than usual, and during the off season, he acquired the right to use a number of olive presses the following spring. If you’re interested in a straightforward investment platform that goes hand in hand with some of the best checking and savings accounts today, Ally could be the right fit. For stocks, ETFs, options plus $0. Investors can purchase options include equities, indexes, debt securities and foreign currencies, the focus here is mainly on equity and index options. Open Online Demat Account. Uptodown is a multi platform app store specialized in Android. By taking a loss early, you can prevent it from becoming crippling to your portfolio. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. Robo advisor: Ally Invest Robo Portfolios IRA: Ally Invest Traditional, Roth and Rollover IRAs Brokerage and trading: Ally Invest Self Directed Trading. Traders need to be swift in exiting unprofitable or adverse positions.

Fidelity Investments

Example: If you see 1,000 options traded today volume and 5,000 options still active open interest, it means there’s strong interest in this option. So, options traders are more likely than not to end up losing their premium. You can go either long or short when trading asset’s market prices. Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. When faced with the volatile nature of cryptocurrencies, investors have an ongoing dilemma – exit the position or ‘HODL’. Understanding the regulatory environment around day trading is crucial. StoneX Securities Inc. I don’t want to be enticed to trade, and I don’t want to see a barrage of short term results in my face. Practise trading with a free demo account. Publicly traded companies. Featured Partner Offers. Using multiple moving averages and watching for crossovers as potential entry signals. As traders navigate the fast paced world of intraday trading, they must possess the ability to analyze charts, identify trends, and manage risk effectively. The third group was quoted with trades in $0. These transactions include small orders as well as large block orders.

Media

We’re here 24 hours a day, except from 6am to 4pm on Saturday UTC+8. However, it is critical in the case of intraday trades. The New Market Wizards. IG is regulated globally, and its IG Trading app provides access to a variety of quality trading tools alongside multiple news sources for researching trading opportunities. Service and online brokers have had to expand their offerings and cut costs to stay competitive. They refer to taking a profit at a predetermined price level. A call option gives the buyer the right but not the obligation to buy 100 shares of the underlying usually a stock or ETF at the strike price, on or before the expiration date. Investors should carefully analyze their financial goals, risk tolerance, and market outlook before implementing any option trading strategy. How to do Valuation Analysis of a Company.

Educational resources

These details will be documented in an options trading agreement used to request approval from your prospective broker. How can beginners get started with trading. Set your conditions in a few clicks with simplified creation, or code them yourself with creation by programming. Over time, traders have developed various styles or types of trading to suit their convenience and risk taking abilities. Trading stocks involves various risks, including market volatility, economic downturns, company specific risks, and regulatory changes. Trading types or styles are not mutually exclusive, meaning the adoption of one method does not bar you from adopting other trading styles. By constructing a riskless portfolio of an option and stock as in the Black–Scholes model a simple formula can be used to find the option price at each node in the tree. The book covers crucial aspects such as position sizing, risk management, and the psychological elements that contribute to sustained trading success. “Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning Techniques. To put it simply, they are portions of stocks and ETFs that represent a small amount of an overall share. Available for account queries, ProRealTime, product info and more. Essentially, you’re putting down a fraction of the full value of your trade – and your provider is loaning you the rest. The exchange weathered financial storms, from the Panic of 1907 to the Great Depression, each crisis shaping its evolution and spurring new regulations to protect investors.

Overview

Every month, the brightest quantitative minds use our platform to generate research. Clients may only be enrolled in one offer at a time. Other brokers that offer fractional trading include Fidelity, Interactive Brokers, Webull, SoFi Invest, and Robinhood. That brings you to the beginning, not the end, of your investing journey. Securities and Exchange Commission. Built Up Sector Cycle. Some have been around for decades, while others are relatively new to the scene. This web site discusses exchange traded options issued by The Options Clearing Corporation. Written by Michael Lewis, the narrative revolves around a few main players who bet against the subprime mortgage market and ended up profiting from the financial crisis of 2007 to 2008. Tharp emphasizes the vital distinction of managing these probabilities through discipline: “Position size and cut your losses,” he advises. The risk of loss would be limited to the premium paid, unlike the possible loss had the stock been bought outright. In London, puts and “refusals” calls first became well known trading instruments in the 1690s during the reign of William and Mary. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. For those interested in cutting edge technologies and trends, Opto’s thematic investing approach offers a unique opportunity to tap into innovations driving future economic growth. In swing trading, Fibonacci retracement can help identify retracement levels on a price chart. Globally recognized forex broker. You can paper trade on eToro’s mobile app, too. Technical analysis is the study of historical market data, including price and volume. Each currency has its own code – which lets traders quickly identify it as part of a pair. 60% of retail investor accounts lose money when trading CFDs with this provider. But remember to keep things simple. ECB rate decision: A post summer balancing act. Intraday trades can be as short as a few minutes, depending on market conditions. We then scored and ranked each provider to determine the best brokerage accounts for beginners. Pattern day traders must maintain a minimum account balance of $25,000 in cash and eligible securities. ByBit better than Binance, but don’t say CZ about it 🤭😁. The Impact app focuses on ESG environmental, social and governance investing. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy.

Day Trading Salary

Our platform also offers technical indicators and a Reuters news feed – plus, you can use IG Academy, expert webinars and seminars, and more to learn about trading or to build on your skills. Yes, as long as the share price is below $100 and your brokerage account doesn’t have any required minimums or fees that could push the transaction higher than $100. At a Glance: The Perfect Day Trading Setup. In my experience, this pattern has shown up time and again across various forex pairs, and when it does, it often signals that the market is about to shift. Most options positions can be traded in an IRA retirement account. If you find that you’re having trouble with your trading mindset today, then this list is for you. Below $20, the long put offsets the decline in the stock dollar for dollar. As for the cybersecurity of the app itself, you can always make sure your trading remains as safe and secure as possible by turning on two factor authentication, keeping your mobile phone software up to date, enable biometric access like FaceID/TouchID, and use a strong password that’s not reused elsewhere. In most trends, pullbacks exceeding the 50% and 61. Initially, some traders conveyed their intention to open or close specific operations at certain levels to their followers through newsletters. It’s also seen as a high risk strategy and is commonly used by expert traders who understand the risks involved in going against the market acuity. No order limit, Paperless onboarding. Speciality All types of trading solutions. You also need to note that intraday orders can’t be placed in the pre market session. Practice day trading stocks anytime now from the comfort of your browser within your TraderSync account. Lines open 24hrs, Monday Friday. If a trader is not keeping a close watch on market movements, he/she may incur a loss.

Indian Equities

Overlooking Withdrawal and Deposit Options. Not all stocks are good contenders for intraday trading. Price action is used to analyze trends and identify entry and exit points when trading. Sure, he made millions and had all of the material possessions anyone could want. No promotion available at this time. So, what are the main evaluation criteria when searching for the best crypto app for beginners. But instead of entering trades in the live market, you watch them play out virtually. Plus500AU Pty Ltd holds AFSL 417727 issued by ASIC, FSP No. The focus isn’t just on the volume of information but on its quality and relevance. Buffet’s approach to investing is looking for easy wins, not tackling insurmountable challenges.

What is crypto trading?

It’s determined by a number of factors, including the amount of time left until the contract expires and expectations for future volatility in the price of the underlying asset. 5 decimals for FX 3 on JPY pairs, Spot Metals: 2 decimals for XAUUSD and 3 decimals for XAGUSD. Consider giving them a trial if you are in such a mess reach out to them by email globallspyc @ gmail com. When does the forex market open. This is where Quantum AI comes in. Today, it’s very easy to start day trading. You can do this with eToro¹, and another advanced trading platform IG¹. Our dedicated support team is here to safeguard your investments, guiding you through the markets with confidence. Don’t let one big loss ruin lots of perfectly good trades. Scalper buys coins at a comparatively low price and makes rapid profit by reselling them a few seconds or minutes later. We understand that different clients have different needs. Trading in the global world of financial markets is divided into types on the basis of the period of time during which a position trade is held. Automated bond portfolio available. Consider a stock that’s currently trading for INR 100 a share. Bajaj Financial Securities Limited is only distributor of this product. As traders navigate the fast paced world of intraday trading, they must possess the ability to analyze charts, identify trends, and manage risk effectively. The more active the market, the tighter the spreads you’ll get and the less slippage you’ll experience. Although some of these techniques were mentioned above, they are worth going into again. These are not standardized contracts and are not traded through an exchange. Listen to our Podcast. There are some key considerations when deciding which trading platform is best for your investment objectives, educational needs, and preferred access to markets.

Introduction to Finance and Investment Management

Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations. This applies to waiting for the right opportunity, and then holding the trade to maximise profits. On the other hand, if the dominant market is bearish, it could favour the downtrend where the price could break out of support to continue downwards. The New York headquartered company is a regulated broker dealer, with Securities Investor Protection Corporation SIPC protection in each account up to $500,000. Great option for stock investors and followers. All times are Eastern Time. For a buy order, the limit price will be the most you’re willing to pay. In ‘The Disciplined Trader’, Mark Douglas explores the psychological challenges traders face and offers strategies to overcome them. Its broker dealer subsidiary, Charles Schwab and Co. CoinSmart takes the cryptic out of crypto. In case of unexpected market fluctuations, investors can incur losses. If you’re tempted to invest in the stock market and financial instruments, but don’t have the confidence to do so yet, then Stock Trainer by A Life Software could be the forex trading platform you need. The best options brokers should offer a good balance between costs and features. Difference Between Cash Flow And Fund Flow. Balancing the trade off between volatility and time intervals is crucial for effective tick chart reading. Out of all the trading strategies, position trading encompasses the longest time frame. These are your go to setups that you have tested and work. While a long margin position holds a debit balance, a margin account shows a credit balance with only short positions. Quantities, amounts, figures, graphs and rates shown / displayed are exemplary and not recommendatory or actual. Gross profit = Net Sales – Cost of goods sold. For the brokers that filled out these profiles, we audited the information for any discrepancies between our data and the broker’s data to ensure accuracy. With the right approach and continuous learning, day traders can find success in these dynamic trading environments. Understanding Options by Michael Sincere.

A 6 Step Guide to a Safe and Secure Healthcare App Development

Otherwise, no changes are required to Tick Chart settings. Sign Up for My Free Weekly Trading Tips Newsletter. The finance industry is the most obvious sector where investing and investment skills play a vital role. Here is a table summarising the differences between tick size and tick value. INZ000218931 BSE Cash/FandO/CDS Member ID:6706 NSE Cash/FandO/CDS Member ID: 90177 DP registration No: IN DP 418 2019 CDSL DP No. It’s important to note that most credit card providers do not support crypto purchases. Once satisfied your trading account will be closed in a couple of days. “Trading Systems and Methods,” Pages 733 775. Collaborating with a knowledgeable broker is akin to having a mentor, guiding you through the nuances of the trading landscape. In a sea of nearly infinite possibilities, put each trade you consider through a five step test so you’ll only take trades that align with your trading plan and offer good profit potential for the risk being taken.

Follow us on

When trading derivatives, you can go long ‘buy’ if you think a cryptocurrency will rise in value, or go short ‘sell’ if you think it will fall. Beginners can benefit from the relative ease of buying and selling cryptocurrencies on Crypto. Oscillators include the Relative Strength Index RSI and the Stochastic Oscillator. No need to issue cheques by investors while subscribing to IPO. Here is an example of a gravestone doji reversal pattern. Options trading, by contrast, involves a steeper learning curve. First, open a free demo account and trade using fake money to learn how the trading platform software works. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. If a futures contract on the E mini SandP 500 is listed for $20, it can move one tick upward, changing the price to $20. More sophisticated and experienced day traders may also employ options strategies to hedge their positions. Account opening charges. Residents, Charles Schwab Hong Kong clients, Charles Schwab U. Initiate the transfer process through the new broker. Success in trend trading can be defined by having an accurate system to firstly determine and then follow trends. It’s generally best to close all positions during a day’s trading session and not carry them over to the next day. We have not established any official presence on Line messaging platform. It shows the clear dissimilarity between a passive investor and a position trader in the market. Member Religare Broking Limited RBL : SEBI Regn. Marketing partnerships. 24/7 dedicated support and easy to sign up. Trading a lot bigger than they have done previously can lead to traders giving back the large profits they’ve made, and more. Here are two backtests. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. Scalping is a faster version of range trading, also trying to buy and sell off small price changes to an investment. Runs multiple low latency strategies that trade in bunch of symbols at a time. What are the margin rates with CMC Markets. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Some brokers also allow you to purchase fractional shares, which means you can buy a portion of a share if you can’t afford the full share price.